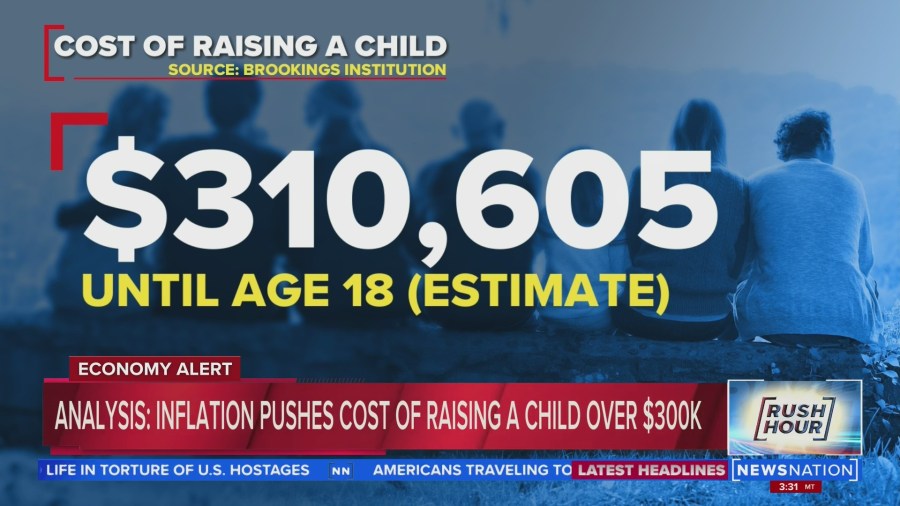

(NewsNation) — The going rate to raise a child through high school has risen to $300,000 according to a Brookings Institution estimate, The Wall Street Journal reported Friday.

The estimate was determined assuming the child was born in 2015 to a family of four, and uses previous government baseline estimates that have been adjusted for inflation.

The figure they came up with was $18,271 a year — or a total of $310,605 through the age of 17 — a figure that nears a four-decade high.

“That number doesn’t include the cost of college,” Dr. Isabel V. Sawhill, a senior fellow in economic studies at the Brookings Institution, said on NewsNation’s “Rush Hour” Friday.

“We call it the opportunity cost — the cost that you’re bearing because you gave up doing something you otherwise would have done, such as working more full-time or in a pressurized job,” she continued.

These rising costs disproportionally affect lower to middle-class parents, particularly single parents making less than $20,000 a year.

“There’s nothing left to cut out,” said Muffy Mendoza, the chief executive officer of Brown Mamas, a network of Pittsburgh-area Black mothers, speaking to the WSJ. “We’re cutting off the cable today because we can’t afford it.”

Along with inflation adjustments and family size determinants, the study factors in everyday essentials, including home, food and clothing estimates, as well as extracurriculars such as childhood milestones, dance lessons and other classes.

While inflation slowed to a still-high 8.5% in July compared to 9.1% for the prior month, food prices have remained very high, almost 11% higher than last year and rising at the fastest pace since May of 1979.

“A lot of people are going to think twice before they have either a first child or a subsequent child because everything is costing more,” said Isabel Sawhill, a senior fellow at Brookings. “You also may feel like you have to work more.”