How higher education institutions spend tuition dollars

NEW YORK (NewsNation) — The skyrocketing cost of tuition at higher education institutions has led many students to question whether college still is worth it or if there are cheaper options out there.

This has led to a growing trend of young adults temporarily moving back in with their parents after graduating due to the economy. Labeled as “boomerang kids” or the “boomerang generation,” for moving out of their family’s home for a time and then moving right back, according to the Pew Research Center.

So, as college students pay more for tuition, where is all that money going?

During move-in day at Boston University, students prepare for the unknown, but one thing they do know is that it’s costing them big — $82,000 a year with room and board.

Michael and Frechell Leachman’s daughter is a freshman who applied to multiple schools, but BU was her favorite, a top-dollar choice.

“Well, I can tell you that a lot went into it for us,” Michael Leachman said. “Even though I think the college here did a good job of breaking down tuition, room and board, those sorts of things — you still look at those cost as individual cost and you’re like wow, that’s an exorbitant amount of money.”

In a recent financial disclosure, for example, BU bragged about making more during the coronavirus pandemic.

“Boston University faced unprecedented uncertainties in fiscal year 2021 due to the coronavirus (COVID-19) pandemic and responded to the challenge. The financial result was another successful year with total assets growing to $8.3 billion.”

BU said it increased revenue in 2021 by 46% — an astonishing $143 million in extra revenue.

Across the country, as tuition rises, administrators are getting richer — even at public universities supported by taxpayer dollars.

NewsNation found the president of Arizona State University got an 8% pay raise in 2021, taking his salary up to $1.1 million. The salary for the president of The Ohio State University comes to $1.2 million, Texas Tech University’s president makes $1.3 million, and the University of Kentucky’s president’s salary ballooned to $1.5 million.

So, what does college tuition pay for? A recent study reveals this breakdown:

- 26% instruction

- 20% academic support, student services, instructional support

- 16% for hospital services

- 4% net grant aid to students

There are also sports. Currently, the highest-paid coach is the University of Alabama’s football coach, Nick Saban, making $11.7 million a year.

Meanwhile, Michael Hicks, a professor of economics at Ball State University, says the goal is still to put the money into the classroom.

“It’s going to go to pay professors, to keep classrooms small. If you have a university that has a high proportion of Ph.D.’s teaching classes instead of graduate students or adjunct professors, that’s going to be more expensive,” Hicks explained.

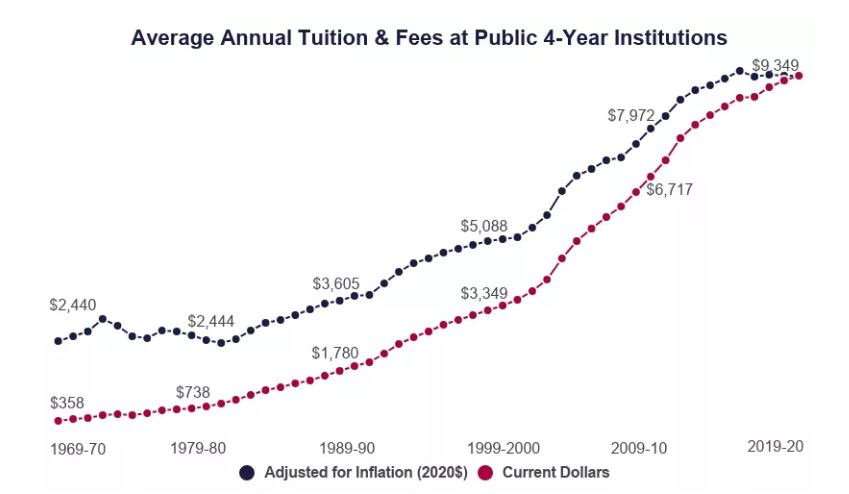

Between 1980 and 2020, the average price of tuition, fees, and room and board for an undergraduate degree jumped by 169%.

In 1980, the price to attend a four-year public institution full-time was $10,231 annually — including tuition, fees, room and board, and adjusted for inflation, according to the National Center for Education Statistics. By 2020-21, the total price increased to $25,700.

While student loans, scholarships and grants are often awarded to students to help with college funding, there’s another option many might not have considered: negotiating a discount on college tuition. It’s something most universities don’t advertise, but it may be possible to negotiate a bargain for a better financial aid package.

“I’m not sure parents know, but an economist knows it; everybody at the university knows it. There are scholarships for students, particularly out-of-state students,” Hicks said.

Private universities lead the way with discounted tuition rates for the 2018-19 academic year, according to a study from the National Association of College and University Business Officers (NACUBO). Tuition discounts are often used as a way to attract students and boost enrollment.

Colleges and universities are in business to make money

The college and university dropout rates are near 40%. The leading reason students are leaving is they can’t afford to pay their tuition.