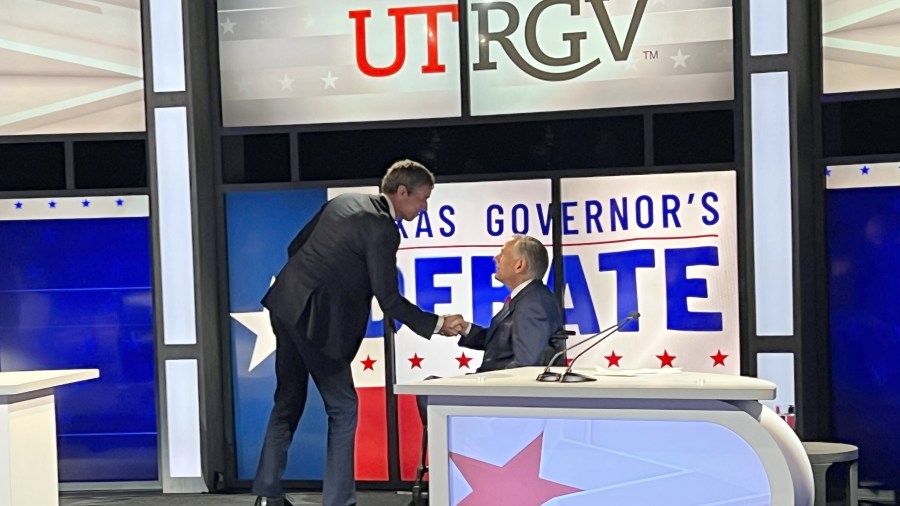

(NewsNation) — Both Texas Gov. Greg Abbott and Democratic gubernatorial challenger Beto O’Rourke claimed they would lower property taxes in Texas if elected in November in response to a NewsNation viewer question at their only debate Friday night.

The state of Texas does not collect property taxes directly; property taxes are collected only by local governing bodies, which use the tax income to fund public education, as well as road repairs and other services.

Property taxes in Texas have been on the rise over the last decade. For eight of those years, Abbott has been governor. In 2011, Texas residents collectively paid $40 billion in property taxes; by 2021, that figure rose to $73 billion, according to the Houston Chronicle.

Abbott points to rising property valuations in Texas, spurred by the state’s booming real estate market, as the reason property taxes have been on the rise, deflecting blame from his office.

Abbott said during Friday night’s debate he would use half of the state’s $27 billion projected budget surplus to issue property tax relief across the state. Abbott said he would use that money to “buy down” property taxes at the local level.

“What the state of Texas has done, and we will continue to do, is to drive down the ability of local governments from being able to raise taxes,” Abbott said. “I am the only one with a bold vision for actually cutting property taxes.”

In 2019, Abbott signed two bills that require local governments to get voter approval if they wish to raise property taxes by 3.5% or more, a law local governments claim have put them in a budget bind.

O”Rourke responded to Abbott’s comment by saying local governments were forced to raise property taxes because they’re issued “unfunded mandates” by Abbott.

O’Rourke said he would mitigate property tax burdens by evening out the spending on public education to be a 50/50 split between property tax revenue and state spending, rather than the roughly 60/40 split he says the state implements now.

“This is how we can turn it around: One, let’s expand Medicaid. We’ll go from a state that’s the least insured to one where everyone can see a doctor or be able to fill a prescription. It will also reduce our property taxes because right now, you are on the hook for uncompensated indigent care,” O’Rourke said. “Two, let’s up the share on state spending for public ed.”

O’Rourke also said he would ensure “property tax fairness” by making corporations, who are “not paying their fair share” of property taxes, pay more.

Legalizing marijuana would also lower property taxes, O’Rourke claimed, by bringing in “half a billion dollars” to the state in revenue.