(NewsNation) — The nation’s poorest renters are bearing the brunt of an affordable housing shortage that stands to worsen without federal intervention, according to a new report.

Despite employment and wage growth since mid-2020, rental costs have outpaced earnings, resulting in an additional shortage of 480,000 available and affordable rentals between 2019 and 2022. That’s according to an annual report from the National Low Income Housing Coalition (NLIHC), which warned the issue is more pronounced now than it was during the COVID-19 pandemic.

“As the supply is going down, demand is going up, and the gap just expands, and what has been a significant problem for a long time has gotten worse,” said Andrew Aurand, NLIHC senior vice president for research.

The shortage of available and affordable homes impacts each state and the 50 largest metro areas, taking a disproportionate toll on the lowest-income earners and people of color. Eighty-seven percent of extremely low-income renters (those at or below the federal poverty level or 30% of the area median income) account for about a quarter of all renters. They also make up 69% of “severely cost-burdened renters.”

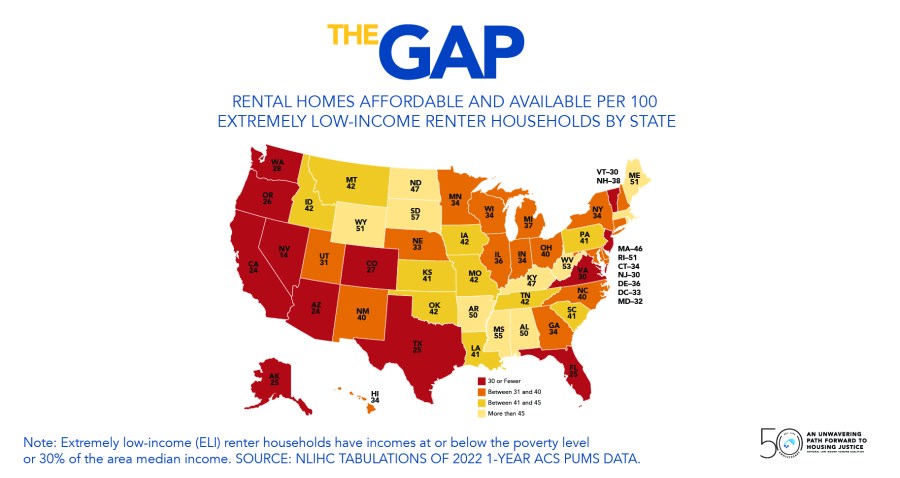

In Nevada, where the issue is most prominent, there are 14 affordable and available rental homes for every 100 extremely low-income renting households.

South Dakota, Mississippi, West Virginia, Wyoming, Rhode Island and Maine are among the states with the most robust supply of affordable and available rentals for extremely low-income households but still face significant shortages.

“Without housing assistance or increases in their hourly wages, extremely low-income renters can’t rely on their work hours to afford their homes,” the report stated.

For every 100 extremely low-income renter households, there are about 34 affordable and available rental homes, according to the report. Those figures represent a shortage of about 7.3 million.

Renters who make more money are beginning to feel the heat, too. The added pressure on middle- and higher-income earners has contributed to the shortage of affordable rentals, as those who earn more move into spaces that would otherwise be available for more impoverished residents.

“Nearly three-quarters of (extremely low-income renters) spend more than half of their income on housing,” Aurand said. “Some spend as high as 70% or 80% of their income on housing, and, of course, that leaves very little for other necessities like adequate health care (and) transportation.”

Once considered a more affordable alternative, manufactured and mobile home options are also slipping further out of reach for many as ballooning rent and financing costs create new barriers.

Those with limited places to turn for shelter are finding themselves doubling up with friends and family, experiencing homelessness or living above their means to keep a roof overhead, Aurand said.

“They’re one crisis away from falling behind on their home,” he said.

State and local government can help ease the burden by providing subsidies, reforming zoning and scaling back other restrictions to support housing production, but the most change will be possible through federal funding, according to the NLIHC.

“With the supply of affordable and available rental homes worsening, Congress must recognize the urgent need for expanding our supply of affordable rental housing, preserving the supply that already exists, and providing short-term assistance when financial crises hit vulnerable households,” the report stated.