FTX founder Sam Bankman-Fried arrested in the Bahamas

(NewsNation) — Sam Bankman-Fried, the founder and former CEO of cryptocurrency exchange FTX, has been arrested in the Bahamas, authorities said.

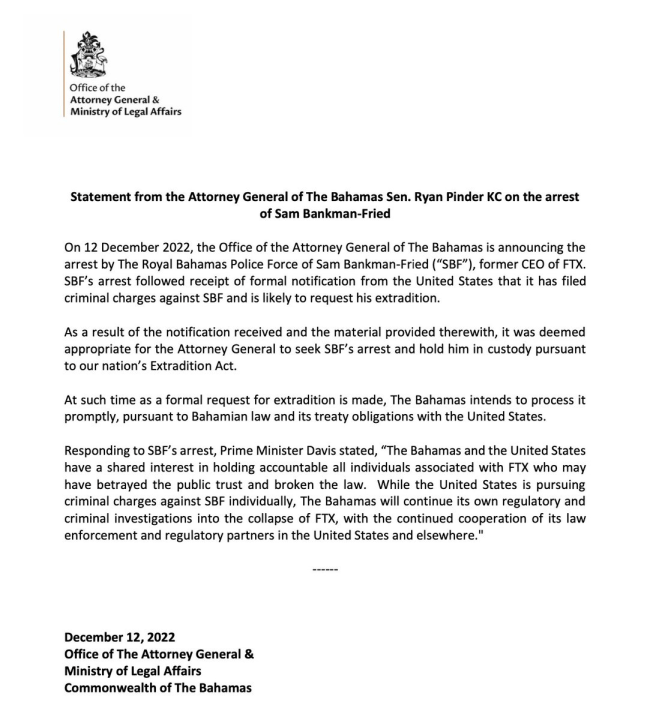

Bankman-Fried was taken into custody Monday after the United States notified the Bahamian government it had filed criminal charges against Bankman-Fried and is likely to request an extradition, the Bahamas attorney general’s office announced in a news release.

Short billions of dollars, FTX filed for bankruptcy and Bankman-Fried resigned after experiencing the crypto equivalent of a bank run. The Securities and Exchange Commission and the U.S. Justice Department are investigating whether FTX used customers’ deposits to fund investments at Alameda Research, possibly mixing client funds with company assets, which is regulated against in most securities markets.

Criminal charges were filed under seal by the U.S. Attorney’s Office for the Southern District of New York, the office said in a tweet. The indictment is expected to be unsealed Tuesday morning.

“I didn’t ever try to commit fraud,” Bankman-Fried said in an interview with the New York Times last month, adding that he doesn’t personally think he has any criminal liability.

The liquidity crunch at FTX came after Bankman-Fried secretly moved $10 billion of FTX customer funds to Alameda Research, Reuters reported, citing two people familiar with the matter. At least $1 billion in customer funds had vanished, the people said.

Bankman-Fried told Reuters the company did not “secretly transfer” but rather misread its “confusing internal labeling.”

During an interview with Leland Vittert, strategic consultant Niki Christoff questioned who else will face culpability in the case.

“Sam’s culpability, civil and criminal, is not just going to be restricted to the southern district of New York or the United States. He’s going to be investigated globally. Most of the investors in FTX are actually from Singapore, Japan, South Korea, so this is a gentleman facing a world of hurt,” Christoff said. “I would not at all be surprised to learn that he was potentially wiretapped at some point in the last few months and that there may be tax evasion charges, market manipulation charges, we’ll almost certainly see wire fraud charges.”

In a statement, Bahamas Prime Minister Philip Davis said his country and the U.S. have a “shared interest in holding accountable all individuals associated with FTX who may have betrayed the public trust and broken the law.”

Bahamian Attorney General Ryan Pinder said the Bahamas would “promptly” extradite Bankman-Fried to the U.S. once the indictment is unsealed and U.S. authorities make a formal request. FTX is headquartered in the Bahamas and Bankman-Fried has largely remained in his Bahamian luxury compound in Nassau since the company’s failure.

A spokesman for Bankman-Fried had no comment Monday evening. Bankman-Fried has a right to contest his extradition, which could delay but not likely stop his transfer to the U.S.

Bankman-Fried’s arrest comes just a day before he was due to testify in front of the House Financial Services Committee. Rep. Maxine Waters, D-Calif., chairwoman of the committee, said she was “disappointed” that the American public, and FTX’s customers, would not get to see Bankman-Fried testify under oath.

Bankman-Fried was one of the world’s wealthiest people on paper, with an estimated net worth of $32 billion. He was a prominent personality in Washington, donating millions of dollars toward mostly left-leaning political causes and Democratic political campaigns. FTX grew to become the second-largest cryptocurrency exchange in the world.

That all unraveled quickly last month, when reports called into question the strength of FTX’s balance sheet. Customers moved to withdraw billions of dollars, but FTX could not meet all the requests because it apparently used its customers’ deposits to cover bad bets at Bankman-Fried’s investment arm, Alameda Research.

The House Financial Services Committee will still hear testimony Tuesday from current CEO, John Ray III. Ray, who took over FTX on Nov. 11 and is a long-time restructuring specialist, has said in court filings that the financial conditions at FTX were worse than at Enron.

Bahamian authorities plan to continue their own investigation into Bankman-Fried.

Reuters and The Associated Press contributed to this report.