(NewsNation) — The rental market is finally returning to pre-pandemic conditions, according to the Apartment List National Rent Report for April 2023.

Nationwide, rents increased 0.5% in March of 2023, and price growth is similar to that of March 2018 and March 2019. Apartment occupancy is also normalizing.

Remote workers have been having a “disproportionate impact” on housing market trends, according to Apartment List. This is expected to continue into 2023.

The share of Americans who work primarily from home tripled from 2019 to 2021, according to Census data. And though some employers have asked workers to return to the office, it seems clear that remote work will continue across multiple industries.

In a recent survey, Apartment List found that working flexibility is leading to higher rates of mobility and shifting geographic preferences.

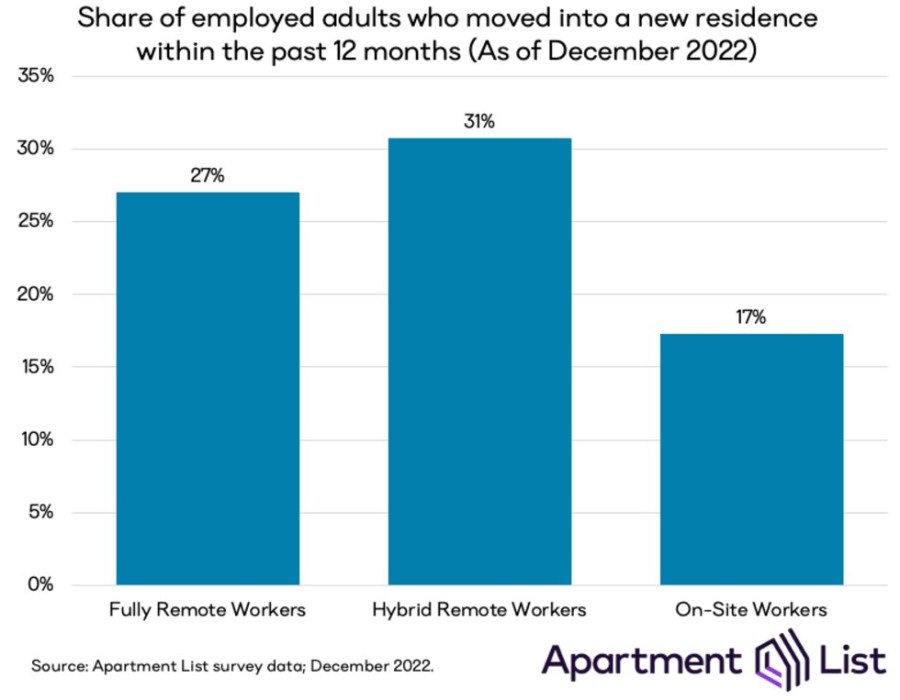

Apartment List surveyed 6,000 employed American adults in December 2022, and those with remote work arrangements were far more likely to have moved into a new home over the last year.

“When we look at remote work migration. I think, really, what we’re seeing here is that the dust still hasn’t settled yet,” Chris Salviati, a senior housing economist for Apartment List, told NewsNation digital.

Surprisingly, the highest moving rates were among those with hybrid remote working arrangements: 31% of those with hybrid models moved in 2022.

Salviati noted that this trend possibly stemmed from people who had fully remote working arrangements, but are now being asked to work in office part of the time.

“Some of these could also be reversed moves. … Now, they’re being asked to come back into the office and maybe have to move back close to the office again. … We can’t identify that precisely in the data,” Salviati said.

In 2021, the national median rent increased by a record-setting 17.6%. This rapid growth in rent prices has been a key contributor to overall inflation, according to Apartment List.

“I think that was driven by some of this remote flexibility, or at least in terms of some of the markets that saw the most extreme disruption,” Salviati added. “I also think part of this was just that we were seeing big growth in household formation, overall.”