Social Security has 12 years left: Preparing for a possible new retirement reality

CHICAGO (NewsNation Now) — Will you have enough saved for retirement? According to the Federal Reserve, one in four American adults has nothing saved for their senior years.

Only one out of every three adults say they’re “on track” financially for retirement and those who don’t save enough will need Social Security.

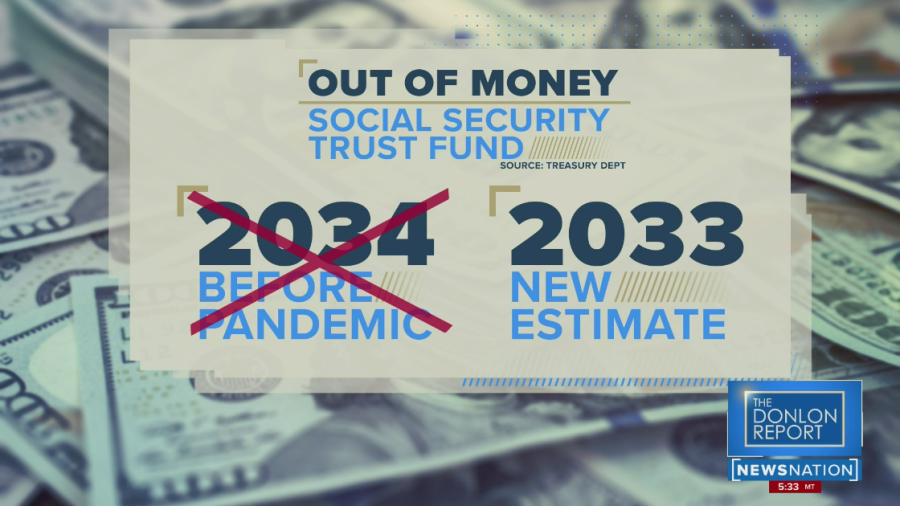

On Tuesday, new projections revealed the Social Security trust fund, where most Americans get their Social Security dollars, is set to run out of money in just 12 years.

The government reported the trust fund will run out of money a year earlier than previously forecast due to the economic impact of COVID-19.

Treasury Secretary Janet Yellen is now promising to safeguard the program.

But Mitch Roschelle of Macro Trends Advisors tells The Donlon Report that millennials and Gen Zers may “never get anything in return.”

“I think likely what will happen is a sort of recasting of Social Security, if this could ever get through Congress,” Roschelle said. “Where those folks who were probably baby boomers, and maybe Gen X that are vested or partially vested in Social Security benefits may be fine.”

Winnie Sun, the founder of Sun Group Wealth Partners, says people who haven’t saved enough for retirement have two choices.

“You either have to bring in more income, or you have to spend less money.” Sun said. “This is the time to think about what our future is going to look like. So it’s the sooner the better.”

Roschelle said some of the possible fixes to the Social Security program are changing when people begin receiving benefits and how much. He says the government should also look at what the private sector has done by moving away from defined benefit plans to defined contribution plans.

“Maybe one of the other fixes is have taxpayers sort of put money aside for themselves and give them more incentives, not less, to save for retirement,” Roschelle said.

“We’ve got to get to a point where people start to take more responsibility for their retirement,” Sun said. “It’s gonna be scary if we factor out Social Security for such a large population.”