(NEXSTAR) – The inflation rate in the U.S. is the highest it’s been since the 1990s and the rising prices are affecting staples such as food, rent, autos and home heating oil, according to Bureau of Labor Statistics (BLS) numbers released Wednesday.

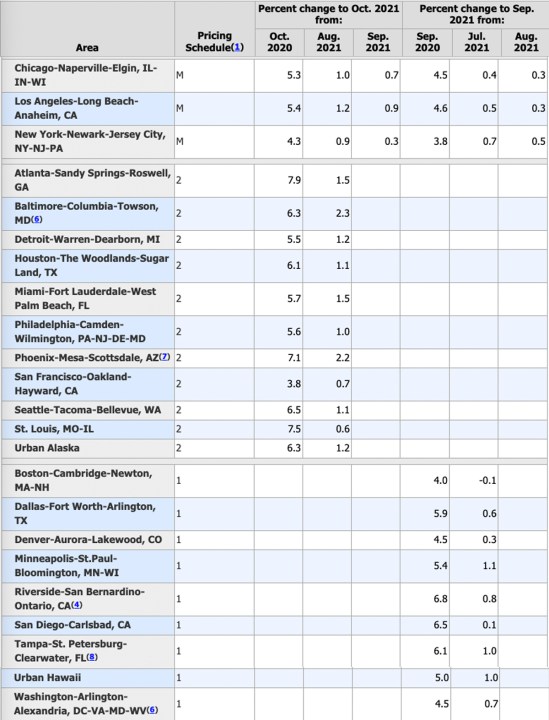

The U.S. as a whole has seen a 6.2% jump in consumer prices since last year, but inflation is also affecting major metro areas differently, with some seeing a greater spike in prices than others.

Leading the country is the Atlanta-Sandy Springs-Roswell metro area in Georgia, with a 7.9% increase over October of last year, followed by the greater St. Louis area (7.5%) and Phoenix-Mesa-Scottsdale in Arizona (7.1%).

The additional strain on Americans’ wallets comes as the country, still in the grips of the COVID-19 pandemic, prepares to enter the Thanksgiving and holiday shopping season.

Before Thanksgiving hosts went shopping last year, the food index was 5.4% less, according to BLS numbers. Grocery staples such as meat, poultry, fish and eggs saw the largest jump (11.9%), with beef the highest of all (20.1%).

What’s causing inflation?

With the widespread availability of the COVID-19 vaccine, demand for a number of products, such as fuel, has jumped as the supply chain continues to cripple supply levels.

Experts also point to hiring challenges, which have forced employers to raise wages and offset that higher pay with a price increase on manufactured goods.

Americans are now spending 15% more on goods as the supply change sags under shipping bottlenecks that drive prices skyward.

The jump in inflation is not confined to the U.S., however, with 19 European countries using the Euro experiencing annual rates over 4% and energy prices soaring 23% — the largest increase in more than a decade.

In the U.S., the pain of inflation is felt more by lower-earning households who spend a large proportion of their incomes on food, rent and gas.

Signs of economic strength

Despite the rising inflation numbers, experts say the economy is showing a sustained recovery from the pandemic recession.

Consumers, on average, have plenty of money to spend, making 2021 different from the 1970s when Americans simultaneously suffered high unemployment and high inflation.

“We’re still looking at an economy in a strong position,” said Sarah House, a senior economist at Wells Fargo. “The consumer is still going out and spending, which is why we are seeing the price gains we’re seeing.”

Republicans in Congress are blaming the same $1.9 trillion rescue package passed in March — a package designed to help people struggling during the pandemic — with the current inflation numbers. The combination of stimulus checks and greater unemployment subsidies drove demand out of sync with supply in the U.S., they argue.

On Wednesday, Biden visited the port of Baltimore and pledged to help rectify some of the supply chain problems behind the rising cost of goods.

“Inflation hurts Americans’ pocketbooks, and reversing this trend is a top priority for me,” Biden said.

How long inflation will continue to rise in the U.S. is not certain, but last week Fed Chair Jerome Powell — who has long referred to the phenomenon as “transitory” — acknowledged that higher prices could last well into next summer.

The Associated Press contributed to this report.