Baltimore bridge collapse will impact shipping industry

- Baltimore port was a 'major economic engine'

- Shipping logistics could take weeks to adjust

- Economic impacts unclear in the short-term

(NewsNation) — The collapse of a Baltimore bridge after being hit by a container ship Tuesday could cause several weeks of delays, reroutes and extra costs to the shipping industry, experts say.

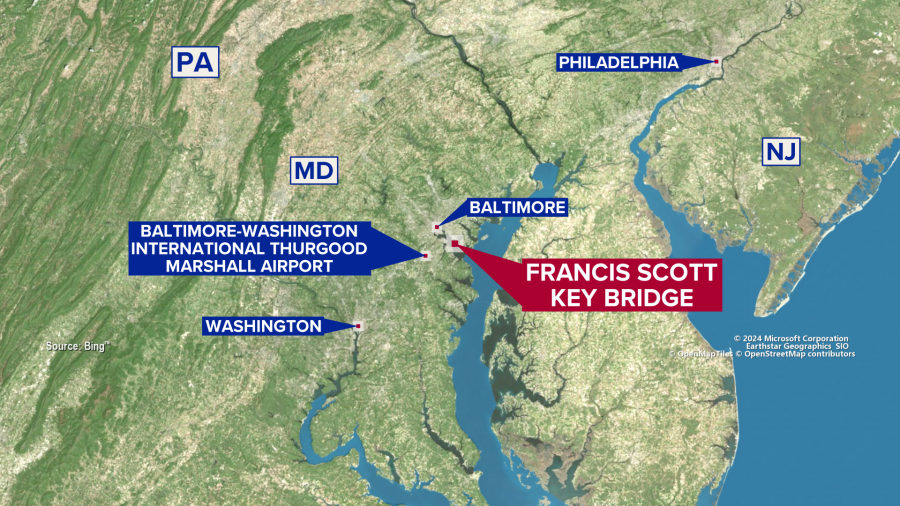

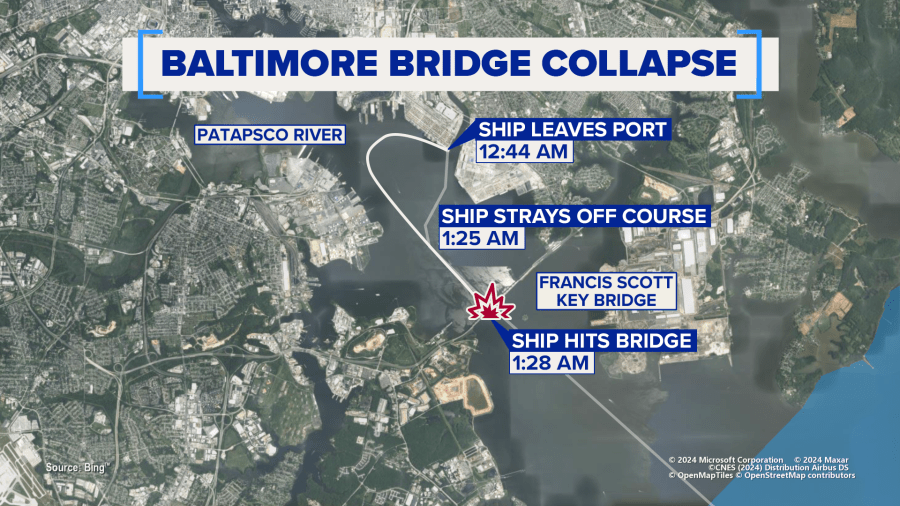

The massive Sri Lanka bound container ship, called the Dali, lost power minutes after disembarking and rammed into the Francis Scott Key Bridge in Baltimore, a key port on the east coast for the shipping industry.

Six people are still missing as authorities continue to investigate the crash.

The bridge stood as a gateway into a significant port along the East Coast used by hundreds of container ships over decades. It also carried a segment of I-695 on the Baltimore Beltway over the lower Patapsco River, according to the Maryland Transportation Authority.

The location of the port near major highways and rail systems made it a prime location for the transport of goods, and now with the bridge out, there is no way for boats to get in or out of the harbor.

Baltimore’s port was a “major economic engine” that will undoubtedly cause both direct and indirect effects on shipping and transport, Alvin Williams, a professor at the Mitchell College of Business at the University of South Alabama, told NewsNation.

“Right now there are a lot of moving parts to this,” Williams said.

Impacts on the shipping industry have already begun and will likely continue in the weeks ahead, industry experts told NewsNation.

Immediate shipping impacts of the bridge collapse

In the short term, nothing can move in or out of that port until the bridge gets cleared. Boats that were scheduled to go into the port are piling up near Annapolis, Capt. Morgan McManus, master of the Empire State VII ship at State University of New York Maritime College, told NewsNation.

“Those ship owners and operators now have to make a decision whether to deviate to New York, Charleston, or Savannah and offload their cargo,” McManus said. “That’s going to take a little time to get worked out.”

Those ships will need to book other ports and get dock spots. At this point, it’s a routing issue as to where the ships can go and also a rerouting issue for how to get the cargo out, he said.

For the boats that are stuck on the opposite side of the bridge, McManus explained freight operators are now scrambling to get truck chassis to offload their stock and get it someplace else.

As the logistics are figured out, small businesses may feel a pinch.

“It’s going to affect any of the local businesses that relied on shipping directly out of Baltimore because they’re going to incur costs of having to move their product for export to a different port,” he said.

Shipping industry flexibility

The ripples of the Baltimore port being down will affect shipping for the entire East because it will add more volume to the other ports including in New York, Charleston, and Savannah, McManus said.

But overall, the shipping industry is flexible and agile at making adjustments, he said, saying the logistics of changing course will take a couple of weeks as opposed to months.

“The other ports are going to absorb the volume of the import and export and they can handle that,” he said. “Over time they’ll work it out. You might have longer times waiting for a dock because of the real estate space of getting a ship alongside, but I don’t see it being that substantial.”

Long-term costs are still unknown

The collapse could have an impact on consumer costs depending on how the industry economically pivots.

Rerouting ships will have varying degrees of costs and at some point, those costs could potentially be passed on to consumers who may see that impact in the next three to six months, Williams said.

The industry could also just absorb that cost themselves and keep moving, McManus said.

He added the point of the infrastructure system is to be cost effective and move products as cheaply as possible, so the bridge collapse will produce challenges to that.

“All that remains to be seen,” he said. “It will take some time to let the economy work it out.”