Renters gain power in housing market

(NewsNation) — The rental market is “rapidly shifting in the favor of renters,” according to RealPage, a real estate software company.

“Renters facing lease renewals suddenly have a lot more options — often attractively priced as apartment operators push hard to keep occupancy elevated,” RealPage economist Jay Parsons said in a report last month.

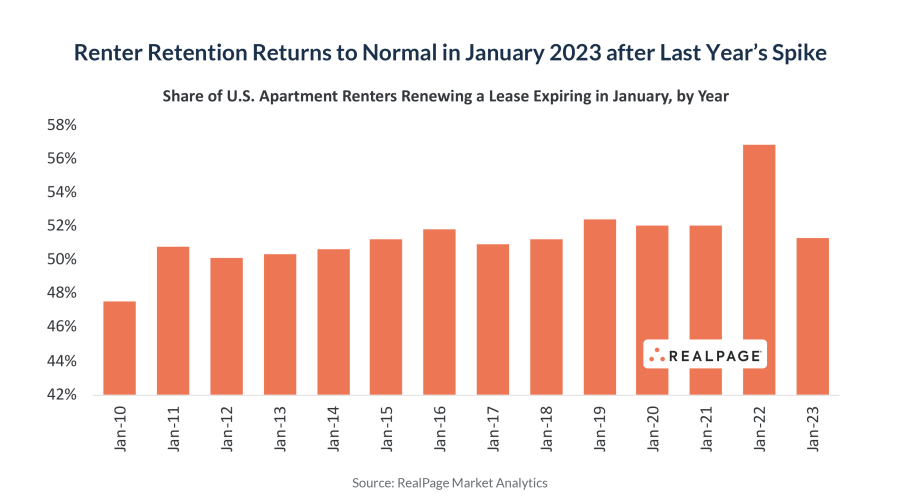

Unlike in 2021 and 2022, when it comes to leasing renewals, renters have more incentive to shop around for better-priced alternatives.

Prior to February, no metro area in the United States experienced positive rent growth for six months, according to the Apartment List National Rent Report for March 2023.

This favorable trend, among tenants, is expected to continue due to a “robust supply of new inventory hitting the market” this year.

For the first time in six years, the national median rent price showed consistent decline from August through January, according to Apartment List data.

The drop in rent comes after the U.S. experienced sky-high rental prices triggered by the coronavirus pandemic. Over the course of 2021, the national median rent increased by 17.6%

U.S. migration actually continued to decline from 2020 to 2021, according to the Census Bureau. And Realpage noted that Americans mostly stayed put in 2022. Multiple reports show that apartment vacancies have gradually increased.

Apartment List’s vacancy index currently stands at 6.4%, which is the highest it’s been in two years.

“We expect that supply constraints will continue to soften. 2023 could be the first time since the early stages of the pandemic that we see property owners competing for renters, rather than the other way around,” the Apartment List report reads.

Realpage also noted that a total of 971,356 apartment units were under construction at the end of 2022, with about 575,500 scheduled for completion in 2023.

Despite positive rent growth, landlords need to compete for tenants or else units will stay vacant.